How a Mastercard business card

helps improve business

processes in a company

Business is on the rise, and expenses are growing - for the purchase of equipment for new employees, for business trips, for meetings with high-ranking customers and counterparties around the world.

In order to optimize costs, the company issued corporate Mastercard® cards for key employees.

What came of it? Let's talk clearly.

What are the benefits of a

corporate card?

End of the check war

Aleksey often conducts negotiations at the highest level. And now he is going to meet with a major potential customer in Budapest. Previously, the process of organizing a business trip and especially a report on it was stressful for him. He was rarely satisfied with the services of a travel agency.

It was also not easy with entertainment expenses: I had to make an advance payment in advance and wait for the transfer of funds, keep all the checks, they were always lost in my pockets. A lot of time was spent on the reports, Alexei usually drew them up “by eye”, the amounts did not converge regularly. As a result, it was not always possible to justify in the accounting department and compensate all the amounts. How to avoid mutual reproaches.

On the eve of his trip to Budapest, Alexey received a nominal corporate Mastercard with a limit of 3,000 usd per month, about which he was immediately warned for convenience and transparency in cost planning. In accounting, he was only asked to download the application SmartData to account for expenses, where it is enough to fill in three items: date, service, amount. He independently booked a convenient flight and chose a hotel room according to the company's policy and in accordance with his limit - receipts for payment via Mastercard came to e-mail. As well as a cash receipt for a taxi at Sheremetyevo (besides, 20% was returned to him as a cashback - a nice privilege from Mastercard).

Negotiations in Budapest in a restaurant with local flavor were successful. Even an unexpected incident did not spoil the atmosphere: the waiter said that the payment terminal was broken, cash was needed. The account was large, but Alexei was not upset - in the accounting department he was warned about the possibility of withdrawing cash from the card in foreign currency. It works in any country, the conversion takes place automatically at the internal exchange rate of the bank in usd. The accounting department will be able to calmly recalculate the expenses, the main thing is to bring a check from the restaurant.

Returning home by taxi, Aleksey was pleased as never before. First, he brought a new major contract. And secondly, thanks to the use of a corporate card, he was able to make a trip report in just eight minutes right in the application on his smartphone. He even decided that perhaps he should please the accounting department with Hungarian gifts - marzipan sweets.

Comprehensive support

General Director Anton has planned a week-long trip around the regions - you need to personally meet with several industrial clients to discuss the functionality of the new industrial development. Three cities, five flights. Anton himself did not have to draw up reports for business trips, but he meticulously collected all the checks and gave them to his assistant. However, it was on this long trip that he mentally thanked the chief accountant ten times, who advised him to issue a card for business owners. Mastercard Preferred BusinessCard®.

The first three days flew by quickly and productively - even ideas appeared on how to take into account the new tasks of clients in the current development. Traveling did not tire him either - Anton stayed at the hotel of his favorite company chain, which allowed him to accumulate points and spend them on subsequent bookings for all employees. But I had to think about colleagues on a business trip more than Anton had planned. The director of one of the factories told him about the increasing cyber attacks on the enterprise. Anton could not sleep for a long time, imagining how many holes in the cyber defense of his business became after some of the employees switched to work from home.

And then the lead developer somewhat hysterically wrote on WhatsApp that the power of his old machine was no longer enough, that the deadline for one of the orders was in danger, and even sent a link to a computer that, according to its characteristics, is more suitable for a large-scale project. Remembering that he had promised to replace equipment for a long time, but all hands did not reach, Anton decided not to put off the purchase indefinitely - he ordered the necessary hardware and software in the online store, paying Mastercard Preferred BusinessСard® from the company's current account. Purchases of furniture and equipment for business needs, as the chief accountant told him, do not raise questions from the tax authorities. Having solved the developer's problem, Anton finally fell asleep peacefully.

In the morning, however, surprises awaited him again, but even here the business card helped to cope with the challenges. The last meeting was the most difficult in terms of logistics - four hours by car from Novosibirsk to the factory. However, upon arrival, it turned out that the transfer company mixed up the dates and booked a car with a driver for the next month.

Anton took advantage of Mastercard Preferred BusinessСard ® — I booked a premium taxi for the whole day (thanks to the discount, this turned out to be even more convenient). The change did not upset him at all - the accounting department will accept such documents.

Force majeure insurance

The ambitious development director has a new goal: Irina has planned to open a company office in Shenzhen. The financial model is ready, and she will have to assess the situation on the spot and sign cooperation documents. Getting ready for the airport, Irina thought about the prospects for business and left home later than planned. Caught in an unexpected traffic jam, missed the flight. Negotiations - in two days: if you do not have time, then you can fail a serious deal. At the airport, Irina pulled herself together - as a key employee of the company has a limit on her Mastercard Business Preferred® is 40,000 usd.

At the airline counter, Irina was able to quickly, without negotiations with the accounting department, purchase a ticket for the next flight. She received the documents on the replacement of the ticket with a surcharge right there. After a comfortable waiting in business lounge Mastercard Irina still flew to China. But the adventure didn't end there. Having already arrived, the development director discovered that she had left her corporate card at the counter at the Moscow airport. And the possible expenses on this business trip significantly exceeded the available funds on the personal card

The risk of being left without money and not making the right impression on partners was eliminated quickly. By phone, the Mastercard technical support service not only blocked the card, but also indicated the nearest bank office where you can urgently reissue it. A few hours later, Irina received her card. But in order not to find herself in such a situation again, she immediately tied it to an electronic wallet in her mobile phone. Long meetings with Chinese partners were quite sincere. The expansion operation was saved thanks to Mastercard.

Transparency

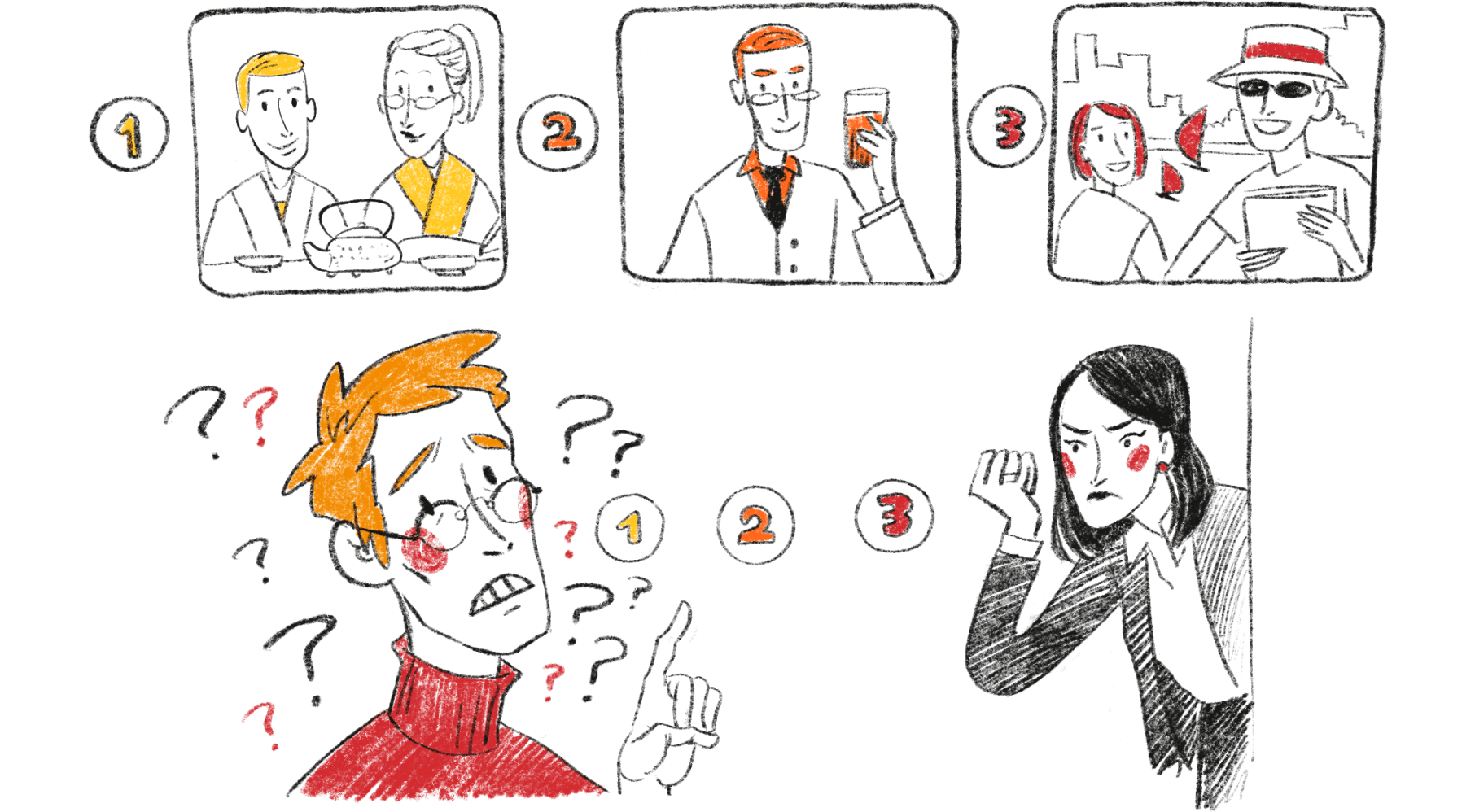

IT evangelist Ivan is responsible for promoting products and technologies developed by the company. He is dedicated and considers it his personal goal to ensure that every potential user knows about them. Corporate blog, presentations and webinars, thematic conferences and exhibitions - what he just does not do.

As a result, Z company's developments are well known in the market. But in the accounting department, until now, they did not understand what Ivan was doing. There he found himself when he brought an application for an advance payment for a report, and after that - crumpled checks and receipts, demanding compensation. In the reports drawn up on the knee of Ivan, the numbers always did not converge. The accounting department eventually conjured over the puzzle of the received "documents" and the rationale for these costs. Moreover, some checks regularly raised doubts. For example, from restaurants for large sums (dinner with partners?!) or a wake surfing club (networking with consumers?!).

Giving Ivan corporate Mastercard, the accounting department limited expenses to the amount of 100,000 usd per month, so that Ivan finally learned to choose the really most important activities. The innovation took him by surprise. He was just trying to dock three planned trips. With the set limit, the questions disappeared - it was necessary to choose one thing. A check with a description of the purpose of the event and the exact date of the event came to the post office, which was required for reporting. In other conferences, Ivan decided to participate remotely, he also paid for the registration with a corporate card. The work of the evangelist of company Z has become clear and transparent for everyone - the accounting department sees cost analytics not only throughout the organization, but also for each employee who has been issued a card.

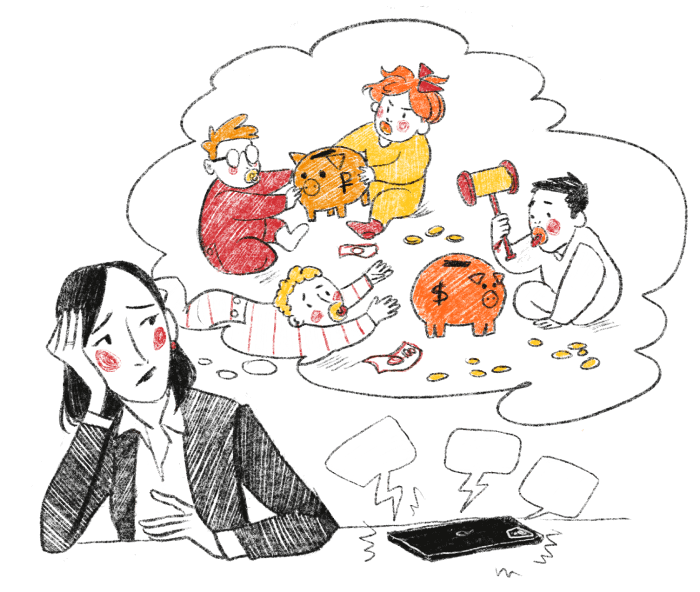

Spending at a glance

Chief Accountant Maria Fedorovna is a demanding pragmatist. Before each business trip or business event, she had to check whether the applications were filled out correctly, coordinate them with her boss, issue money for a report, instruct all employees and top managers on what documents to collect. Arranging hospitality expenses has always been her headache. In order for everything to go quickly, each employee had to inform her in advance about their travel plans and write an application for an advance payment under the report. This document had to be signed by the head of the company, and then have time to transfer funds to the employee on the card or pay them in cash from the cash desk.

Difficulties arose from scratch: someone forgot to tell about their plans in advance, did not have time to get documents, fill in the plates, and an important business trip fell through. If an employee did not spend the entire amount, the money had to be withheld from the salary - many did not understand what was the matter, and scandals arose. The overspending of the issued funds also took time for re-registration. And also those eternally half-erased fiscal receipts and an incomplete set of documents from hotels.

It’s also a problem with the purchasing department: it’s impossible to understand that it’s impossible to order several laptops “right now” or ended, as always unexpectedly, stationery, they categorically did not want to. With any mistake or acceptance of inaccurate documents, there is a risk of problems from the regulatory authorities. And she was also sure that somewhere in the depths of her soul all the employees called her a gargoyle and therefore did not come to drink tea with her homemade cakes.

Convincing management of the need for corporate cards Mastercard, she hoped that business processes would go faster and become more transparent. For each card, Maria Fedorovna set an individual spending limit: 40,000 usd for the CEO and financial director, from 10,000 to 30,000 usd for employees from the sales and promotion department. The control of corporate expenses of employees turned out to be so simple that the chief accountant was able to open all the cards at the same time and further track where, when and for what amount the payment was made. You can forget about the need to arrange in advance the transfer of funds under the report. And if the expenses are made by the general director, then after the trip you will not have to demand documents from him at all.

It is now possible to generate a report for each employee several times faster. Part of the checks comes in electronic form, and the rest is provided by the employees themselves - there is not so much left to save as before. Previously, she spent two days collecting and processing cost analytics for the CEO, but with the new application, everything turned out to be quick and convenient: the accountant uploaded all the data in a couple of clicks.

Since Maria Feodorovna has always been far-sighted, she also issued a corporate Mastercard for herself. And she very quickly assessed her capabilities: while the general director was away, her office was flooded. Maria Fedorovna quickly paid for urgent repairs, ordered contractors to replace damaged furniture. And most importantly, now she will not have any problems updating accounting programs: recently the technical department forgot to renew her package. Now she can buy everything she needs for work on her own. And finally, he will arrange for himself a subscription to professional literature.

With the appearance of corporate cards in the company, Maria Fedorovna suddenly realized that she had free time and a good mood. After finishing checking the reports early, she sent a mailing list around the office with an invitation to tea: “No checks allowed!” Everyone ran.

simplify and make transparent the process of issuing travel and hospitality expenses.